- The STR Report

- Posts

- The Lake Effect: Why Waterfront STRs Outperform 🛶

The Lake Effect: Why Waterfront STRs Outperform 🛶

Ready for your third hint? Keep reading to see if you can crack the code. PLUS hear why waterfront properties deliver some of the strongest peak-season returns in the STR game- you should consider diving in. 🤿

Community Perks with The STR Report

🏠 Top-Tier Property Management – Lower fees, higher payouts, and premium service. Built for investors who want performance and peace of mind. See how much more your property could earn—click to get your free performance assessment.

🔎 Personal Airbnb Investment Finder – Connect with an expert to handpick profitable Airbnb properties that match your criteria. With 213+ successful deals, all cash-flowing, you’re in good hands. Take 15 seconds to fill out the form to see how all of these properties are experiencing a 10-15% Cash-on-Cash return.

🤑 STR Loans & More – Need funding for your next short-term rental? Expect expert guidance, personalized service, and the best possible rates.

September 11th, 2025 🇺🇸

Good evening STR Report Community!

In today’s issue, you will find:

🤫 Insider Scoop: What’s Coming Soon: Hint #3

📱Today’s Article: The Lake Effect: Why Waterfront STRs Outperform 🛶

📈 Trending Market Highlight: Big Bear Lake, California and Jackson Hole, Wyoming

✉️ STR News: Hospitable launches Cleaner marketplace for short-term rentals

💸 Mortgage Rate Watch

🦦 Unique Airbnb of the Week

🏫 Subscriber Perks: Go Live Playbook, including: Beginner’s Guide E-Book, Guest Communication Messaging Templates, Airbnb Welcome Guide Template, STR Buy Box Template, & Tax Savings E-Book

✅ Community Perks: Top-Tier Property Management, Personal Airbnb Investment Finder, and STR Loans & More

📬 See our collection of newsletters here: Prior Newsletters

Our partners have been quietly building something that could change how you think about short-term rental investing. 🏡 🗺️ 🤫

Before we can share more, we’re going to give our readers some hints over the next few days. Be sure to open our newsletter daily to unlock the latest hint, and reply to this email if you think you’re onto something! 😉

Hint #3: True or False

STR investors using market intelligence tools can identify markets with 20–30% higher average occupancy rates compared to investors who rely only on manual research.

Scroll to the bottom of the newsletter for the answer!

🌊 Lakefront STRs: Seasonal Goldmines for Savvy Investors

If there’s one truth about short-term rentals, it’s that water sells. And when that water comes with a private dock, sunset views, and space for the whole family, you’ve got a booking magnet on your hands.

Lake destinations like Lake of the Ozarks or Lake Tahoe transform into bustling seasonal hubs every summer. Travelers plan their trips months in advance, booking for multi-night stays and often traveling in large groups. That means you’re not just filling weekends—you’re commanding premium ADRs for extended stays, with some markets seeing rates jump as much as 90% in July and August.

Even smaller lake markets like Brainerd, MN see impressive numbers, averaging 65–75% occupancy in peak months. These properties are ideal for investors who want strong ROI concentrated in a shorter booking window, and they naturally attract repeat guests who return to the same spot year after year.

The trade-off? Winters can be brutal in northern markets, and lakeside communities are increasingly looking at STR regulations. But for investors willing to manage the seasonality and maintain docks, boats, and septic systems, the summer upside more than makes up for the downtime.

Markets to Consider:

Lake of the Ozarks, MO

Lake Tahoe, CA/NV

Brainerd, MN

Lake Norman, NC

Pros:

📈 Strong seasonal upside with ADR surges up to 90% — Peak summer months often see explosive demand, allowing owners to dramatically increase nightly rates and capture a year’s worth of profit in a single season.

🏠 High ROI on waterfront homes due to concentrated demand — Limited inventory of true lakefront properties means well-positioned homes can command a significant premium over non-waterfront rentals.

👨👩👧👦 Ideal for family/group stays and multi-night bookings — Larger homes with dock access attract big groups who tend to book extended stays, reducing turnover costs and boosting total booking value.

Cons:

❄️ Harsh winters (MN) = sharp off-season drop — Northern lakes see a drastic slowdown outside summer, making cash flow more seasonal and requiring higher peak performance to offset quiet months.

📜 STR regulations expanding in lakeside communities — Many popular waterfront towns are tightening rental rules, which could limit future operating flexibility.

⚓ Higher maintenance costs for docks, boats, and septic systems — Waterfront ownership comes with upkeep expenses that can eat into margins if not budgeted for.

Additional Considerations

Another factor working in favor of lakefront STRs is their ability to diversify revenue through amenities. Properties that include kayaks, paddleboards, firepits, or even pontoon boats often stand out in crowded markets and justify higher nightly rates. These experiences not only enhance guest satisfaction but also increase the likelihood of positive reviews and repeat bookings—critical drivers of long-term rental success.

On top of that, lake homes can provide personal value to investors beyond financial returns. Many owners block off a week or two during the summer to enjoy their property with family, effectively turning the investment into a lifestyle asset. This mix of personal enjoyment and high seasonal yield makes lakeside STRs particularly appealing for investors who want both cash flow and quality of life benefits.

Lakefront STRs aren’t without challenges—seasonality, regulations, and maintenance can test even experienced hosts. But for those willing to plan strategically, budget for upkeep, and maximize summer demand, they represent some of the most lucrative opportunities in the short-term rental space. Simply put: water sells, and smart investors who capture that demand can turn a few peak months into a year’s worth of returns. 💵

Big Bear Lake, California 🐻

Downloadable Big Bear Lake, California Short-Term Rental Market Report

|

Average Daily Rate (ADR): $438.63 per night

Occupancy Rate: 35.94%

Annual Revenue Potential: Around $76,327 per year

Read our full Big Bear Lake, California Short-Term Rental Market Report attached above.

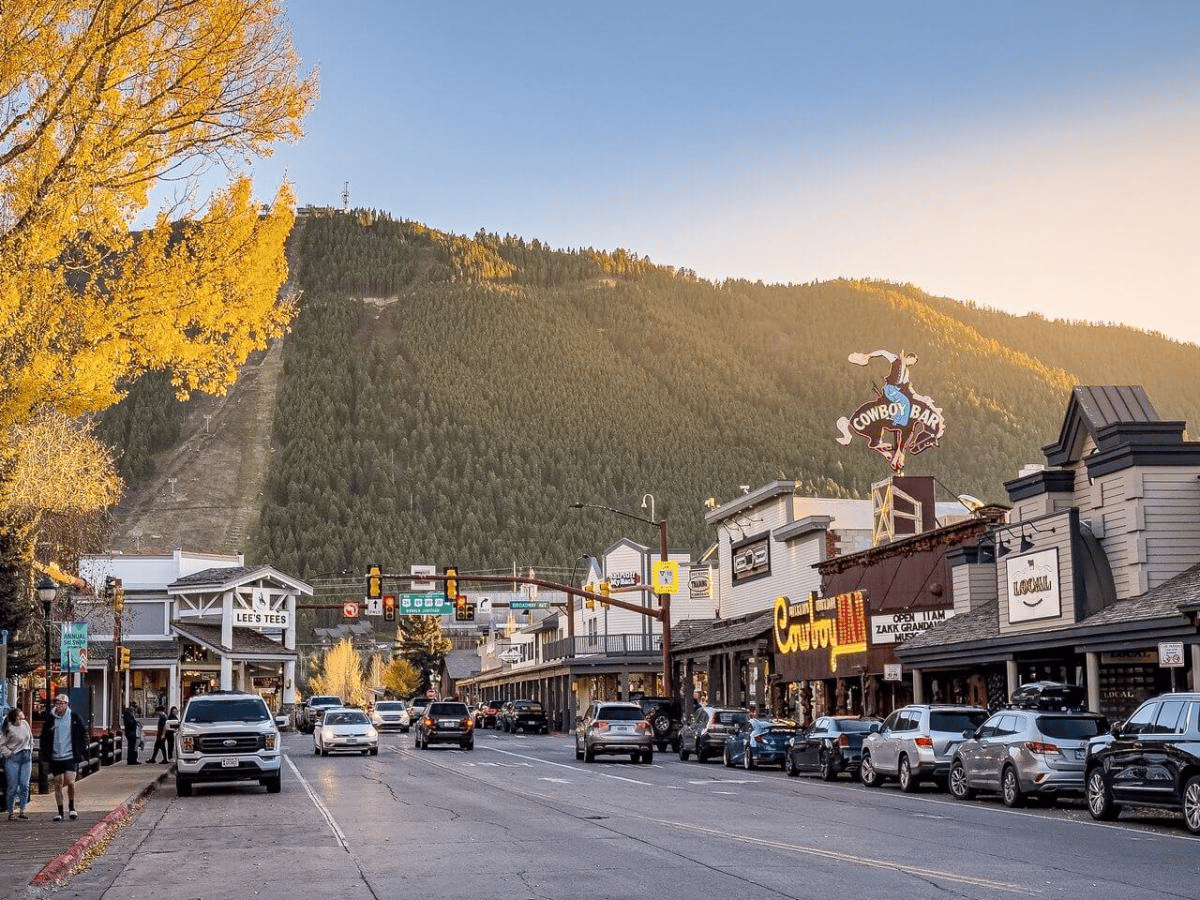

Jackson Hole, Wyoming 🏇

Downloadable Jackson Hole, Wyoming Short-Term Rental Market Report

|

Average Daily Rate (ADR): $753.79 per night

Occupancy Rate: 55.65%

Annual Revenue Potential: Around $136,815 per year

Read our full Jackson Hole, Wyoming Short-Term Rental Market Report attached above.

📬 See our collection of 80+ market reports here: Prior Trending Market Reports

🧽 Hospitable launches Cleaner marketplace for short-term rentals

Property management software company Hospitable has unveiled its new Cleaner Marketplace and a major update to its Operations platform, introducing end-to-end automation for property turnovers and care.

💻 Airbnb’s Brian Chesky: AI Opens New Markets, ‘Everything Is Now Back on the Table’

Airbnb's Brian Chesky said the emergence of native AI apps — there currently aren't any in travel — changes the ballgame, and the company can consider entering new businesses that it previously thought were off limits.

📱 Beyond launches first dedicated app

Beyond, the revenue management and dynamic pricing platform for short-term rental operators, has launched its first dedicated mobile app for iOS and Android, giving hosts, property managers, and revenue teams on-the-go access to its core tools.

🏝️ Inspirato Considers Rival Bid From Exclusive Resorts

At an infinitesimal fraction of the scale, an Inspirato-Buyerlink reverse merger, with both entities controlled and operated by Payam Zamani, would be something akin to Musk's Tesla going out and making a deal to acquire his AI startup xAI. Neither would be a good look.

💸Mortgage Rate Watch – September 11th, 2025

Current Mortgage Rates (as of September 11, 2025):

30-Year Fixed: 6.29% (no change)

15-Year Fixed: 5.70% (+0.01%)

30-Year Jumbo: 6.25% (no change)

30-Year FHA: 5.99% (+0.01%)

30-Year VA: 6.01% (+0.01%)

7/6 SOFR ARM: 5.65% (−0.03%)

Market Overview: Mortgage rates have held essentially steady today, with the 30-year fixed rate remaining at ~6.29%, one of its lowest in recent months. Bond markets showed mild improvement, helping rates avoid upward pressure, even as broader economic signals remain mixed.

Rate Trends & Forecast:

Short-Term: Expect rate stability with minor fluctuations depending on upcoming inflation data and Treasury yield movements.

Long-Term: While expectations for a Fed rate cut are rising (especially if economic indicators soften), further meaningful drops in fixed mortgage rates will likely depend on sustained declines in inflation and long-term interest rates.

For real-time mortgage rate updates, visit Mortgage News Daily.

Bored of staying at regular Airbnbs?

House Upon the Sand is a one-of-a-kind retreat where history meets the raw beauty of nature. Originally tucked away in the woods as a 1920s cabin, this thoughtfully updated home now sits with an unobstructed view of the Hood Canal after a tidal creek reshaped the surrounding landscape, washing away the sandy soil and trees that once concealed it. The result is a cozy yet dramatic setting where rustic charm blends with modern comforts, offering guests a front-row seat to the ever-changing tides, wildlife, and stunning waterfront scenery. Perfect for those seeking both serenity and a sense of wonder, this cabin invites you to slow down, breathe deeply, and experience the natural rhythm of the Pacific Northwest in an unforgettable way.

Answer #3: True.

True. STR investors using market intelligence tools can identify markets with 20–30% higher average occupancy rates compared to investors who rely only on manual research.

✅ Explanation: Data-driven tools analyze millions of listings, revealing hidden high-demand pockets that manual research often misses.

See tomorrow’s newsletter for the fourth & final hint!

Subscriber Perks:

📖🏡💰 Go Live Playbook

The "Go Live Playbook" is your all-in-one guide featuring a beginner’s guide e-book, messaging templates, Airbnb welcome book, STR buy box template, and tax savings tips to kickstart your short-term rental success.

Community Perks with The STR Report

🏠 Top-Tier Property Management – Lower fees, higher payouts, and premium service. Built for investors who want performance and peace of mind. See how much more your property could earn—click to get your free performance assessment.

🔎 Personal Airbnb Investment Finder – Connect with an expert to handpick profitable Airbnb properties that match your criteria. With 213+ successful deals, all cash-flowing, you’re in good hands. Take 15 seconds to fill out the form to see how all of these properties are experiencing a 10-15% Cash-on-Cash return.

🤑 STR Loans & More – Need funding for your next short-term rental? Expect expert guidance, personalized service, and the best possible rates.

Partner with Us!

If you have a project you’d like us to promote, or a product or service you’d like to share, please reach out to us at [email protected].

We appreciate you being a part of our STR community and for sharing our group with your business partners and associates. Thank you!